In a time shaped by economic uncertainty and rising living costs, reliable financial tips are more important than ever. Whether you want to manage your daily financial budget, save money, or learn about effective investments, Wheon.com offers effective tips and clear advice for smooth financial usage.

Many people don’t even know what “Wheon.com finance tips” are, but they want to know what useful advice they provide.

If you are among these individuals, don`t worry, XtraSaaS.com provides a detailed guide on finance tips to secure your finances effectively.

Wheon.com— A Quick Overview

Wheon.com is a blogging website in India based on multi-niche content. It offers fresh, useful, and engaging content across a wide spectrum. Wheon gaming, health, news, business ideas, and lifestyle tips for financial guidance are common among them.

They envision guiding their users through well-researched and easy information, so they can stay updated on trends and make smart decisions in every situation.

What Are Wheon.com’s Finance Tips?

One of this site`s standout features is its Finance Tips section. These tips usually simplify essential money management topics:

- Budgeting by the 50/30/20 rule

- Smart methods for savings

- Strategies for the reduction of debt

- Retirement planning

All these financial tips are conveyed in a concise and actionable format. Wheon.com has gained popularity largely due to its simple, easy-to-read tips and well-structured layout.

Top Finance Tips Highlighted on Wheon.com

After an overview of Wheon.com, let`s have a look at each financial tip.

1. Budgeting 50/30/20 Rule

It is a straightforward framework for balanced budgeting. This rule guides you to allocate:

-50% of your after-tax income to essentials

– 30% of what you want

– The remaining 20% to savings or debt replacement.

Tracking Apps

Apps like Mint, YNAB, or EveryDollar automatically arrange your expenses and make budgeting easier.

2. Saving/ High-Yield Savings

You must keep the money in a separate savings account for an emergency fund. The experts should say that the amount usually covers 3 to 6 months off your basic costs. Yet, putting the money in a high-yield savings account keeps your money safe, grows faster, and is easy to access when needed.

3. Comparing Investment

Investing in an appropriate place like stocks, ETFs, or real estate always grows your money over time. Yet, you can pick options that match your needs, including:

- How much risk are you okay with

- How long do you plan to invest

- What are your goals, or do you want to achieve

Cryptocurrency is very unpredictable. Thus, do proper research at Wheon.com and only invest a small amount into it.

4. Debt Management

Snowball vs. Avalanche Method

These methods are useful and effective for debt management.

- The snowball method pays off your smallest debts first and gives quick wins to stay motivated.

- The avalanche method targets high-interest debts first. It saves your more money in the long run.

5. Planning Ahead

On Insurance

Appropriate insurance plans shield you and your family in unforeseen circumstances, yet increase the amount over time. It keeps your income, assets, and financial future secure.

On Retirement Planning

Retirement accounts like 401(k)s and IRAs help your savings grow. The automated increases (like adding just 1%) can make a big difference without a tax deduction.

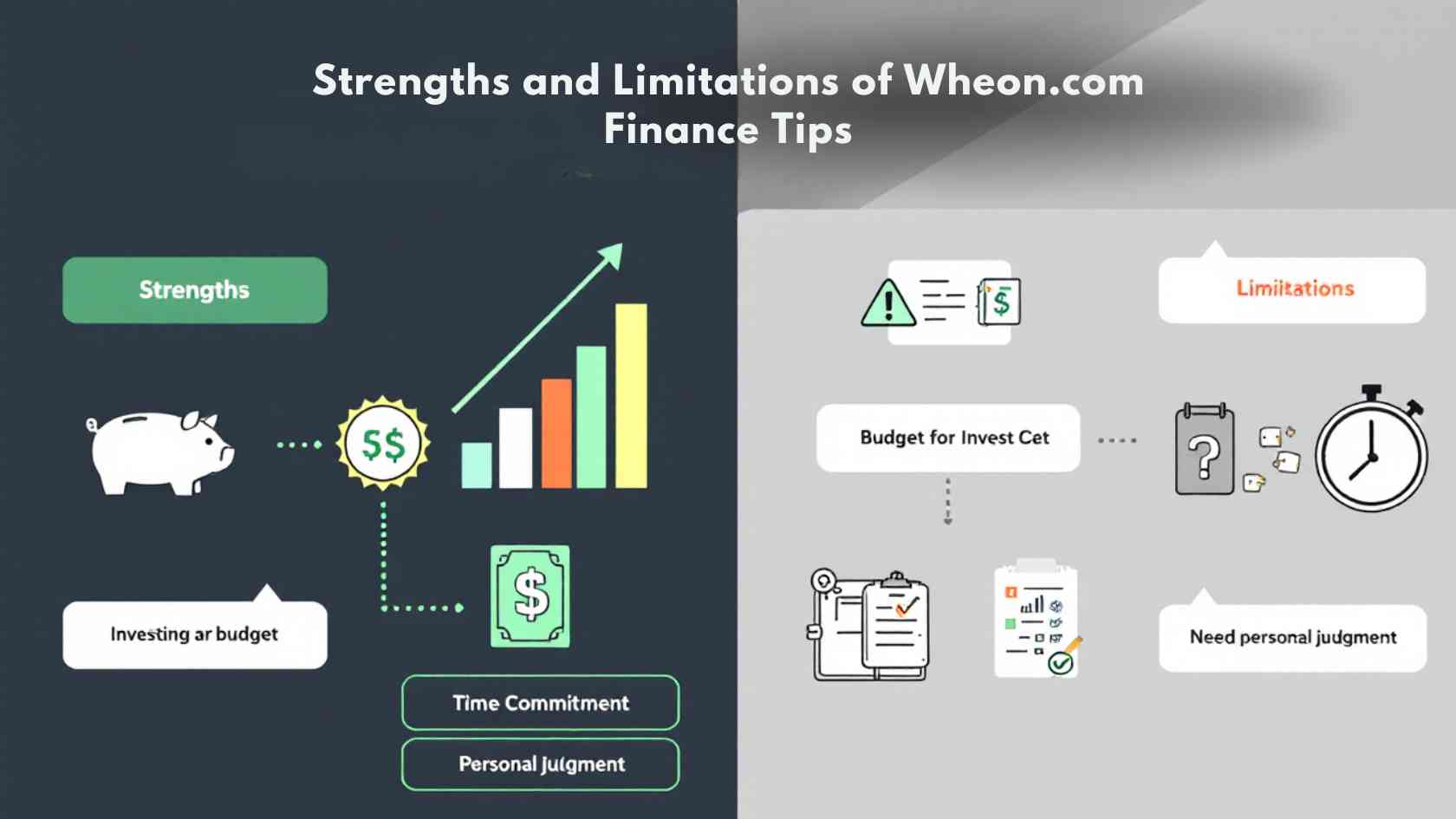

Strengths and Limitations of Wheon.com Finance Tips

These finance tips strengthen your finances in the following ways.

Strengths

Simple & Actionable Advice

Wheon.com delivers financial tips in a language anyone can understand. Write in clear and practical steps that make personal finances more approachable.

Wide Range of Topics Covered

The site does not just stop at budgeting or saving. It also tackles insurance, tax planning, digital payments, and emergency funds.

Focus on Digital Tools & Automation

Wheon.com highlights the usefulness of modern tools like budgeting apps and automating tasks like tracking, investing, and saving.

Limitations

Here are some limitations of finance tips. Let`s have a look at them.

– Lack of in-depth expert analysis, Wheon.com offers, skips nuanced exploration of complex topics, which may leave more experienced users wanting.

– Not provide personalized advice, which means it does not account for individual needs and goals.

– Few real-world case studies, and most examples are hypothetical or concept-based.

XtraSaaS Alternatives to Wheon.com Finance Tips

Here is a complete table that describes how XtraSaaS.com offers enhanced values as an alternative to Wheon.com`s finance tips.

| Category | XtraSaaS Value-Add |

| Advanced Budgeting Strategies | Uses smart AI apps guide to maintain your budget and automatically track your spending. |

| Smart Saving Hacks | It shows how you can earn more from everyday spending, like cash back and credit-card deals. |

| Modern Investing Tools | XtraSaaS.com offers a handy guide on how to use software platforms to monitor investments and support passive income ideas. |

| Planning for Long Term | Provides retirement calculators, financial independence guidance to help users build long-lasting financial security. |

Final Thoughts: Should You Rely on Wheon.com Finance Tips?

At certain times, having straightforward money advice is gold. Wheon.com delivers exactly that with easy-to-follow tips on budgeting, investing, saving, and financial planning for retirement.

These tips are presented in a clear and easy-to-understand format. Besides, XtraSaaS.com brings up these tips and offers tailored guides to beginners and frequent users.

Thus, choose your relevant area and keep your finances secure!